Do a web search for “IoT” or “IoT banking” you’ll get a mashup of predictions, opinions and wildly varying statistics. One source even cites ATMs as IoT devices. Most include things like smartwatches and other “wearables,” smart cars and various digital controls for the home. There’s no definitive list of IoT devises, though. Basically anything that is connected to the internet can qualify.

This confusing picture tends to make people in banking and elsewhere relegate Internet of Things into the category of digital-age buzzword, something to let the geeks flail around about until it gets real, if ever.

That would be a huge mistake.

Not only is IoT already deeply embedded in digital commerce, but as with so many digital technologies, it has been given a boost by the COVID-19 pandemic. IoT payments, in fact, are really the ultimate in hands-free commerce since, by nature, they occur automatically, once set up.

There are billions of IoT devices coming into use around the world right now, states Mercator Advisory Group. (Gartner says it will be 25 billion by 2021.) “These devices collect vast amounts of information and enable a range of payment and logistical capabilities.”

A blog from Autonomous NEXT makes an key point about the general fuzziness of the Internet of Things: “IoT can be simply defined as a network of interconnected digital devices in order to exchange data. Doesn’t this sound like the definition for the internet? Effectively the Internet of Things is purely a term of scale, in which the ‘things’ are any device that can be connected to the internet.” That could be temperature, lighting and security controls for the home or fleet tracking and safety controls for a logistics company.

But as the article points out, the big tech companies have realized that the future of technology isn’t all about hardware, and this view applies equally to IoT. “Rather, the future of technology should be centered around machines working together to make magic.”

EY backs this up, noting that “IoT is the heartbeat of the Fourth Industrial Revolution — a revolution of game-changing innovation made possible by the combination of big data, analytics and physical technology.”

Intelligent Water Pitchers and Much More

The folks at Mercator Advisory Group took a deep dive into IoT payments. They created a framework for not only defining, but gauging the size of, the IoT payments market.

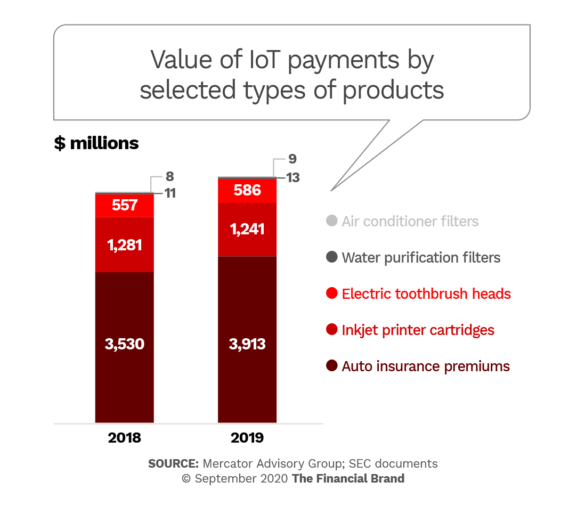

The research and consulting firm did not attempt to determine the size of the entire IoT universe. Rather it focused on how IoT is changing payments in several standard industry classifications within the U.S. In just five product categories, the total of actual, not forecasted, IoT payments exceeded $5.8 billion in 2019, Mercator found.

David Nelyubin, Research Analyst at Mercator, gave one example of an “invisible” or embedded IoT payment occurring right now. The Brita Infinity Pitcher, he said during a webinar on the research, detects when a filter needs to be replaced. It doesn’t just remind the consumer to buy a replacement, but orders and pays for the new filter pack on its own.

Naturally the consumer has to agree to this and set up whatever means of payment they prefer to use. With almost all IoT payments the existing payment “rails” are used — credit or debit cards, ACH or SWIFT, according to Tim Sloane, Mercator’s VP of Payments Innovation, who spoke with Nelyubin during the webinar.

The largest category Mercator looked at was with IoT-enabled insurance payments. In a podcast Sloane said that Progressive Insurance offers some policyholders the option to put a transponder in their car, which tracks average speed, where the person drives, and other data. Based on that Progressive tailors the price of its insurance plan to the consumer’s driving habits. As the chart above shows, such automated payments were already topping $3.9 billion in the U.S. in 2019.

What Is and Isn’t an IoT Payment

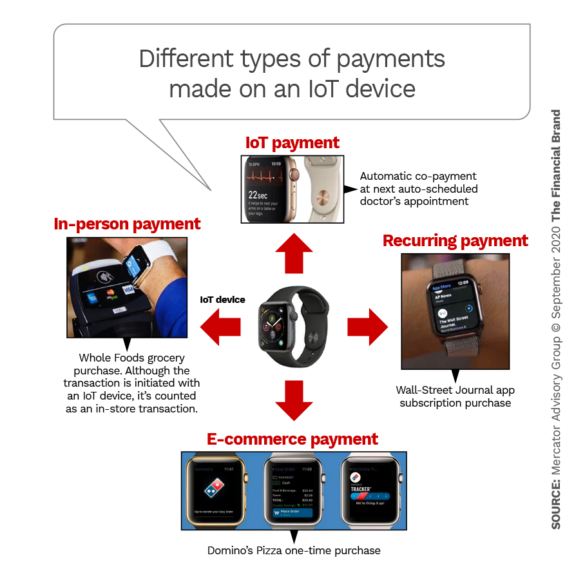

Mercator’s intent with creating an IoT payments framework was to assist both financial institutions and other businesses to more accurately determine the size, scope and opportunity of IoT payments. Further, the analysis seeks to clarify just what is and isn’t an IoT payment. As the diagram below illustrates, the IoT device itself (a smartwatch in this instance) is not the determining factor.

Of the four examples depicted, only the top one is, in Mercator’s view, a true IoT payment. In that case the smartwatch, with a doctor’s appointment in its schedule, recognizes when the wearer walks into the office at the correct date and time and automatically pays the co-payment. It’s an intelligent combination of data, analytics, geolocation and payment connectivity. The other examples in the diagram, although they use the smartwatch as a payment device, are either initiated by the consumer or are following a predetermined schedule.

Banking transformed webinar

The Future of the Cloud in Financial Services

Join Jim Marous, and Bharat Bhushan IBM CTO to understand the challenges and opportunities of cloud computing adoption and the considerations that can influence the scope of cloud deployment.

INSTANT PLAYBACK - WATCH NOW!

Big IoT Boost to Come from ‘Connected Cars’

An important emerging category of IoT payments is known variously as “connected cars” or “in-car commerce.” Most every new car is being built with internet capabilities and connectivity, Sloane observes. Both Visa and Mastercard are deeply involved in this rapidly developing market, though it remains fragmented and in its early stages. In-car payments, facilitated by IoT, would enable people to pay for gas or food without handling cash or even a plastic card, a big plus in a pandemic environment.

In a blog on its website, Visa describes how IoT payments simplify the process of buying gas, for example.

“Consider your average trip to the gas station,” Visa states. “You need to locate a station, get out of your car, dip your card, and pick your fuel grade. With a connected car, we can alleviate those pain points by connecting your car to a digital payment credential (called a ‘token’), and then have the car find the nearest gas station, select the fuel grade, and turn the pump on — all before you get out of the car — so that the only thing left for you to do is pump.”

One specific use case that could involve financial institutions directly in the emerging car-commerce IoT market was identified by Olabisi Boyle, Senior Director of IoT for Visa in a statement to Payments Source. This would involve credit cards co-branded by banks and automakers to be embedded in consumers’ digital wallets enabling them to earn rewards for car repairs, according to Boyle. She says the card would be digitally issued in the car showroom.

“By getting into car commerce, Visa and Mastercard can prevent themselves from being displaced and, by capturing the everyday spending consumers will do from connected cars, ensure growth in volume over their networks,” Bryce VanDiver, a partner at consultancy Capco, told the same publication.

The Importance of IoT for Financial Institutions

Both Visa and Mastercard are actively engaged in initiating partnerships with various IoT players in order to hedge their current business models as IoT impacts their existing revenue streams. Banks and credit unions should take note.

In some ways, IoT payments present a similar situation to the role that fintechs, notably PayPal, play in payments, which is to say, huge. Even though a financial institution is still a part of most fintech transactions — as issuer of a card or holder of a checking account — a portion of the revenue in some cases goes to the “front end” provider. More importantly, the customer relationship often begins to migrate and so does much of the data. It is much the same with IoT payments, which often involve nonbank players, the biggest of which is Amazon.

Active involvement in IoT will help banks and credit unions wrest some control already lost to Amazon. Right now, Amazon is the key IoT platform, David Nelyubin maintains. Each manufacturer has their own app, he states, but Amazon is the overarching platform for IoT. The ecommerce giant is highly focused on its Dash automated replenishment option — not the early version that featured a physical button linked to the web, but a virtual version connected to individual brands or connected to IoT-enabled devices directly.

Nelyubin tells The Financial Brand that Amazon’s Dash program allows devices (like electric toothbrushes) to be connected to Amazon accounts. “When the device signals that a payment must be made to pay for a replacement,” he says, “the payment will travel through Amazon. Many companies are building this payment option directly into the app of their IoT device.”

Banks’ Trust Edge Should Be Used

One advantage traditional financial institutions have in IoT payments is trust. “The opportunity here is for financial institutions to think through the relationships that are going to exist [in IoT] and consider whether they can be a market maker on the commercial side,” Mercator’s Tim Sloane states in the webinar. “That breaks [clients] out the Amazon model and brings that model into the financial institution that has the trust.”

In addition, financial institutions and payment networks “can create specialized programs around IoT that will help them differentiate in the market,” Nelyubin notes.

“IoT payment value and transaction amounts are at the core of financial institutions’ decisions on whether to provide services for a certain sector,” he adds. Note, however, that this revenue potential is attractive not only to financial institutions, but to fintechs, processors, gateways, and other providers who offer payment-related services in a crowded field.

"traditional" - Google News

September 23, 2020 at 12:43PM

https://ift.tt/361rnnc

Will IoT Payments Disrupt Role of Traditional Banking Providers? - The Financial Brand

"traditional" - Google News

https://ift.tt/36u1SIt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Will IoT Payments Disrupt Role of Traditional Banking Providers? - The Financial Brand"

Post a Comment