The fortunes of SPAC initial public offerings ascended while traditional IPOs slumped during the initial three months of the pandemic-induced downturn.

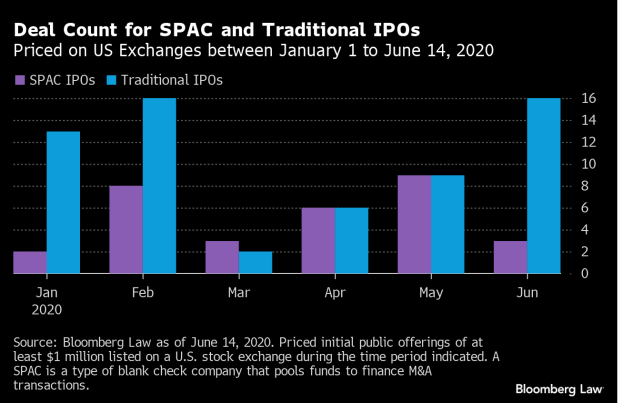

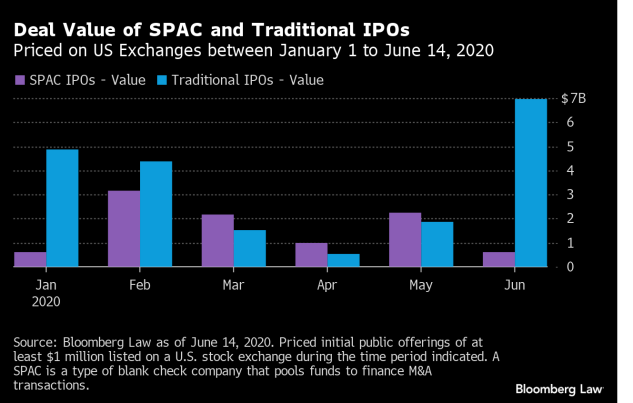

The months of March, April, and May saw SPAC IPOs (IPOs of special purpose acquisition companies) largely reach or exceed parity with traditional IPOs in deal count and deal value. The IPO market returned to its usual patterns in June.

This astounding development reflects essential differences between traditional IPOs and the IPOs of SPACs.

What Made SPACs So Attractive?

Traditional IPOs are typically completed by businesses, usually start-ups, with track records of performance and several years of audited financial statements for analysts to evaluate. These are genuine, functioning—although perhaps still money-losing—enterprises.

SPACs are an investment vehicle in search of an investment opportunity. SPAC IPOs have accounted for about 20-25% of IPOs in recent years. They are shell companies, often sponsored by experienced private equity managers who promise investors they will find an attractive merger or acquisition target within 24 to 36 months. (Recently, however, 18–21 months has been the norm.) The investor receives shares and warrants, and their investment monies are held in trust while the sponsors look for a target. After investors are presented with the M&A opportunity chosen by management, an investor may choose either to stay in the deal if it is deemed attractive or to redeem their shares plus interest if it is not.

The Covid-19 pandemic has brought about unprecedented business closures, record unemployment, and an unpredictable stock market. Traditional IPOs are ill-suited to this volatile, highly uncertain environment: The challenge of accurately assessing the current and future business prospects of a start-up conducting a traditional IPO is simply too great.

SPACs, however, offer many advantages in such an uncertain environment. The structure affords managers considerable flexibility in the type of target, deal timing, and terms of a future deal. Investing in a SPAC IPO typically provides investors with helpful safeguard mechanisms common in M&A deals, such as:

– contingent value rights for shareholders if a specific event occurs,

– contingent consideration or earnouts to sellers based on the business achieving certain financial goals, and

– escrow arrangements holding back part of the purchase price so the buyer may confirm the seller’s reps and warranties.

A Return to a More Traditional IPO Market?

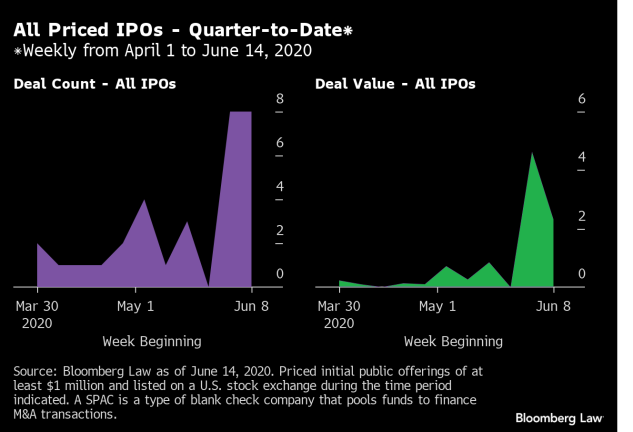

Since late April, IPO activity has increased and the types of companies going public have broadened. And since June 1, the market has gained considerable momentum. (June is normally a busy month for companies going public.)

Despite volatility increasing in June, IPOs are being completed in increased numbers over May. This is entirely due to a resurgence in traditional IPOs, which more than made up for a decline in SPAC IPO activity from May to June.

Traditional IPOs in just two weeks in June are now matching the market’s February count and greatly exceeding the total deal value of any prior month this calendar year. Perhaps this is merely restless investors anxious to get back in the game? It is too soon to declare a return to a more normal IPO market, but the signs are encouraging for traditional IPO registrants and investors hoping for a better IPO market conditions—especially with many unicorns looking to go public later this year.

If you’re reading this on the Bloomberg Terminal, please run BLAW OUT <GO> in order to access the hyperlinked content.

"traditional" - Google News

June 16, 2020 at 05:37PM

https://ift.tt/2Y6CBCd

ANALYSIS: Fortunes of SPAC, Traditional IPOs Diverge in Pandemic - Bloomberg Law

"traditional" - Google News

https://ift.tt/36u1SIt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "ANALYSIS: Fortunes of SPAC, Traditional IPOs Diverge in Pandemic - Bloomberg Law"

Post a Comment