Merchants Bancorp in Carmel, Ind., is back on track with Small Business Administration lending after the pandemic dealt its program several hard blows.

The $9.7 billion-asset Merchants had just begun to establish itself as an SBA lender early last year when fallout from government shutdown orders decimated its nascent business. Carefully developed relationships pulled back and lending opportunities dried up.

“It was Armageddon, chaos, a lot of confusion,” Jeff Scott, the company’s SBA group president, said in a recent interview. “We lost about 100% of the pipeline we’d originated.”

A year later, Merchants has rebounded.

Since resuming traditional SBA lending in June, Merchants has generated $3 million in revenue from selling the guaranteed portions of its loans, with more than half coming in the first quarter. The company also made $94 million of Paycheck Protection Program loans last year as it waiting for the economy to recover.

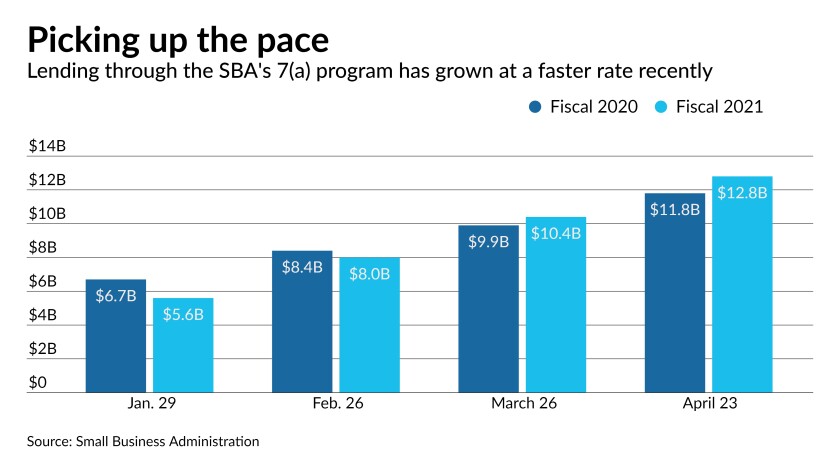

Merchants’ experience is playing out on a wider scale. Last year, once PPP got up and running, lending under SBA’s regular 7(a) program slowed, even after Congress authorized enhancements to make it more attractive. Regular 7(a) lending totaled $22.6 billion in fiscal 2020, the lowest level in six years.

As PPP enters what will likely be its final month, a large number of lenders are looking to make more traditional SBA loans. Bankers said demand for 7(a) and 504 loans is up sharply, spurred by enhancements embedded in the federal government’s stimulus efforts.

Guarantees for 7(a) loans were increased from 75% to 90%. User fees for 7(a) and 504 loans have been waived and the SBA has been making several months of loan payments for borrowers in both programs.

Through April 23, 7(a) originations were up 9% from a year earlier and 1% from the same period in 2019, totaling $12.8 billion. Originations of 504 loans were up 22% from a year earlier to $4.1 billion.

The 7(a) program enjoyed its best two weeks of 2021 between April 9 and April 23. More big weeks are likely to follow as the Paycheck Protection Program expires, said Tony Wilkinson, president and CEO of the National Association of Government Guaranteed Lenders.

“I expect the last half of May, June, July and August are going to be big months for 7(a) — and for the 504 program for that matter,” Wilkinson said.

Under 7(a) the SBA guarantees loans originated by participating banks. The 504 program offers long-term, low-interest financing, usually for commercial real estate and heavy equipment purchases.

First Bank in Hamilton, N.J., has streamlined its SBA lending operation by creating a centralized lending team. The bank’s gains from selling SBA loans increased to $534,000 in the first quarter from $98,000 a year earlier.

First Bank’s previous system, where commercial relationship managers tried to respond to SBA needs “got kind of cumbersome,” said Peter Cahill, the $2.4 billion-asset bank’s chief lending officer.

Traditional SBA originations at MUFG Union Bank in San Francisco are nearly triple what they were in the first quarter of 2020, said Todd Hollander, the $135 billion-asset bank’s head of small business and business banking.

“We believe the enhanced guarantee and other borrower incentives will enable Union Bank to help more businesses recover from the pandemic," Hollander said Friday in an email.

The same holds true at Live Oak Bancshares in Wilmington, N.C., the nation’s largest 7(a) lender.

“The SBA enhancements certainly helped us and other banks gain a little bit of confidence and lend money,” said Mike McGinley, the $8.4 billion-asset company’s head of small-business banking.

“Over the rest of this year, the SBA enhancements could continue to produce activity in the secondary market,” McGinley added. “You’re going to have banks still doing a lot of lending because of those enhancements, so I don’t see that slowing down. … There’s going to be a ton of momentum.”

While about $27 billion of funding authority remains for the 7(a) and 504 programs, Wilkinson and other participating lenders believe the rapid growth in both programs could lead to issues later this summer.

“We think there’s a decent probability we’ll exhaust our funding allocation this [fiscal] year,” Wilkinson said.

“We may be wrong. We may not exhaust the funds,” Wilkinson added. “I just think as we get further into the recovery, further into the summer and farther away from PPP, shuttered venue grants, restaurant grants, the only option left will be the traditional SBA loan programs.”

The federal government's fiscal year ends on Sept. 30.

Live Oak, which is generating SBA loans across several sectors, expects the pace of growth to accelerate throughout the summer and fall. “The second half of the year has always been a lot higher for us in terms of loan volume,” McGinley said.

Waived fees will prompt more businesses to look at SBA, First Bank CEO Patrick Ryan said during a conference call to discuss first-quarter results.

“I do think you’re going to see a higher percentage of small-business financing happening through SBA, partially because of the [financials] and the fact the fees have been waived,” Ryan said.

While the fee waivers are a “huge” incentive, Scott said the higher 7(a) guarantee is perhaps a bigger inducement for banks to make more loans.

“That’s kind of the fuel for what’s probably going to be an explosion of 7(a) growth this year,” Scott said.

Merchants is looking to make 7(a) and 504 loans in several new markets, including Florida, Texas and other parts of the Southeast.

“I think you’re going to see a huge run-up in business and volume,” Scott said. “We intend to do our part to make sure that happens.”

"traditional" - Google News

May 03, 2021 at 11:28PM

https://ift.tt/2QJGsVc

Traditional SBA lending on upswing as PPP's days appear numbered - American Banker

"traditional" - Google News

https://ift.tt/36u1SIt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Traditional SBA lending on upswing as PPP's days appear numbered - American Banker"

Post a Comment