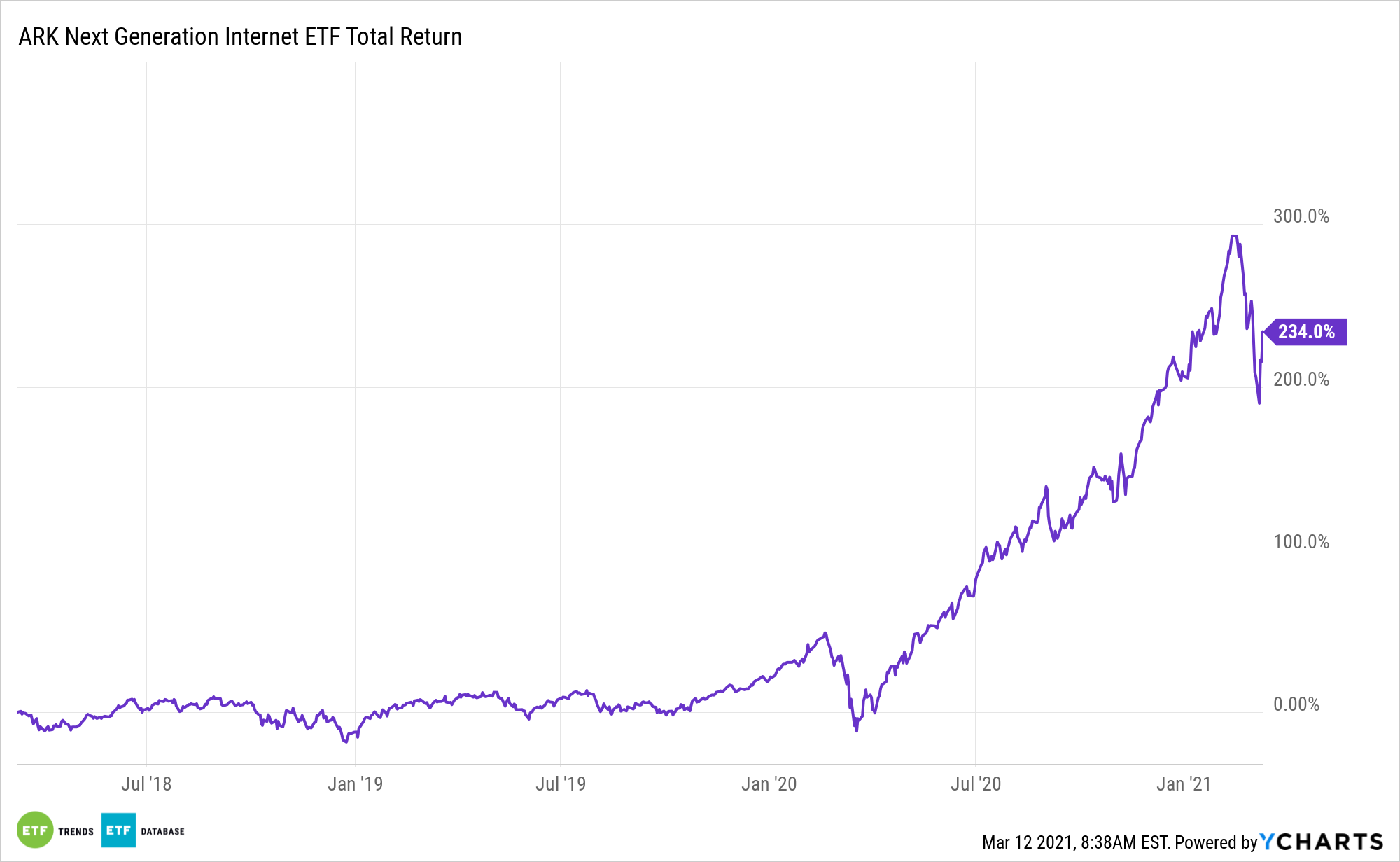

At the hands of streaming entertainment, linear television is bleeding market share and, in the eyes of many market observers, dying a slow death. Investors looking to capitalize on that situation should consider the ARK Web x.0 ETF (NYSEArca: ARKW).

ARKW aims to capture long-term growth with a low correlation of relative returns to traditional growth strategies and a negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets.

“Linear TV has offered viewers thousands of channels for a seemingly low price, but users today want more modern options and a better deal. While ~86 million households in the US still pay for linear TV, its days seem to be numbered,” said ARK analyst Nicholas Grous in a recent note. “Disruptive innovation typically follows a pattern: it evolves slowly at first and then all at once. Since peaking in 2011, the number of US linear TV households has declined 2.1% at an annual rate. That said, according to our research, by 2025, the number of US linear TV households will be cut nearly in half, from ~86 million at the start of 2020 to ~44 million, a level last seen more than 30 years ago, as shown below.”

Still a Bright Future for Media, ‘ARKW’

Be it cord-cutting, online retail, or social commerce, ARKW has a legacy of allocating to disruptive corners of the internet segment.

ARKW components “are focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media,” according to ARK Invest.

See also: Today’s OverARKing Story? 5 ETFs from Ark Investment

Thanks to the likes of Netflix, Amazon.com Inc. (NASDAQ: AMZN), Roku (NYSE: ROKU), and more, the streaming space is becoming increasingly competitive. That competition spotlights the utility of a fund such as ARKW, which helps investors avoid stock picking on their own.

“Connected TV platforms are becoming a threat to traditional media companies. TV operating systems like Roku, Fire TV, and Android TV motivate many, if not most, television purchases. During the next five to 10 years, if the ad market for streaming soars, as we believe it will, TV operating systems like Roku will benefit from the share shift in revenues, taking 30% of the ad load on each of their channels,” according to Grous.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

"traditional" - Google News

March 12, 2021 at 08:45PM

https://ift.tt/30BKUGD

As Traditional TV Disappears, Play the Cord-Cutting ARKW ETF - ETF Trends

"traditional" - Google News

https://ift.tt/36u1SIt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "As Traditional TV Disappears, Play the Cord-Cutting ARKW ETF - ETF Trends"

Post a Comment