Parametric insurance is driving a vision of simplified claims handling, innovative insurance processes and improved customer experiences. (ALM Media archives)

Parametric insurance is driving a vision of simplified claims handling, innovative insurance processes and improved customer experiences. (ALM Media archives)What if insurance carriers knew when a qualified loss occurred and issued payment to policyholders right when they need it most, hassle-free?

Is it too futuristic to be realistic? No. In fact, parametric insurance products do just that.

Insurers are increasingly leap-frogging traditional products with new approaches to avoid substantial processing costs and keep claims cycles short and efficient. The result has been the emergence of parametric insurance policies that payout specified amounts on notification of a loss.

Many traditional insurance companies are exploring ways to partner and integrate InsurTech solutions and improve their own processes. By understanding the fundamental concepts employed and lessons learned, traditional insurers may avoid a disruptive shift by adopting concepts from parametric InsurTechs.

Claims processing basics

Traditional claim settlement typically follows six steps.

- Notification: The insured suffers damages and reports the incident to their insurance carrier.

- Investigation: A carrier representative receives the loss report and confirms the claim’s eligibility against the policy definitions.

- Adjudication: An adjuster verifies the incident, assesses damages and arranges for estimates. Claim reserves are set aside for future payout.

- Settlement: The insurer pays out the reserves to the restoration services, or replacement providers and/or cash settlement offers to policyholders.

- Negotiation: If the insured is not satisfied with the adjudication results, negotiation effort is required to reach a consensus resulting in potential arbitration or, occasionally, litigation.

- Payout: The insured receives the payout or repairs or replaces the damaged items or property, and the file is closed.

How can parametric insurance help?

In the developing world, drought can translate to disaster as farmers suffer long-term economic losses. New crop insurance offerings are leveraging simplified parametric-based coverage that includes:

- Loss Triggers — High-resolution satellite images or weathervanes monitor for metrics indicating drought conditions. When those specific parameters are present, a payout is triggered.

- Payout — Qualified policyholders are identified, and payment is remitted to pre-configured accounts.

Extreme weather events such as cyclones and hail storms are easily identifiable. Crop insurance targets those with the highest risk exposure for economic loss and provides immediate relief when conditions are present. They can prevent additional disasters with the potential of growing into humanitarian crises.

Art of the possible

As predictive data tools continue to advance, the possibilities seem virtually limitless for the application of parametric financial services.

Smart medical devices that capitalize on the Internet of Things (IoT) could identify when a health insurance policyholder is experiencing a health issue such as a heart attack.

Smart home products with IoT features could self-report property damage and trigger a home warranty or insurance claims.

Imagine an airline cancels a flight. A travel insurance policyholder on that flight receives a notification and an option to file a claim or reschedule.

Imagine that during a wildfire, a homeowners’ insurance payout is automatically triggered after an evacuation order. This immediate payout could cover out-of-pocket living expenses with a more detailed claim assessment to follow later.

Or, after a car accident, the insurer and emergency personnel could be automatically notified of the damage.

Insurance industry opportunity

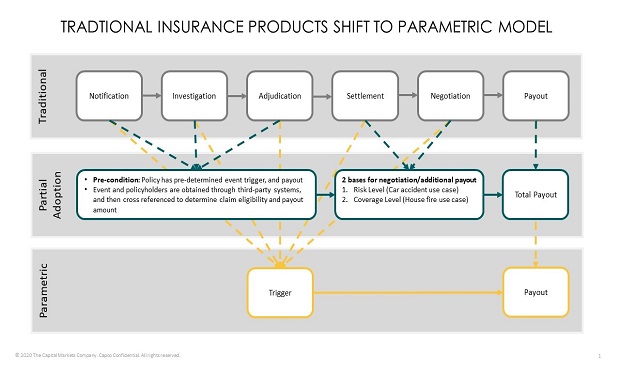

Graphic provided by Capco.

Graphic provided by Capco.Parametric insurance products have pre-determined payouts at the time of purchase. It has been described as “a trade-off between the increased speed that cash is made available to customers and the irrefutable nature of the amount paid out.”

But does the shift to parametric insurance have to be all or nothing?

Capco’s use cases demonstrate how insurance can be fully parametric at the policy level, the coverage level, or the risk level. Policyholders do not need to self-fund, which can potentially cause other hardships such as credit and interest charges.

Leveraging these concepts offers insurers opportunities to:

New key capabilities, crucial for successful execution, need to be considered for parametric products:

- How can we define triggers that are fortuitous in nature and quantifiable, so a given event, with the right conditions, automatically triggers the claims process?

- How can we predicatively model the risk to determine the payout rather than adjusting for loss based on an actual event?

- Parametric triggers reported from trusted independent data sources, how do we protect against fraudulent reporting?

The takeaway

In the early days of insurance, when a community member suffered a loss, local representation resolved the claim quickly. With modern data tools, however, national and global insurers can act locally.

Parametric insurance is driving a vision of simplified claims handling, innovative insurance processes and improved customer experiences. The approaches align with the fundamental purpose of insurance: To protect against financial loss. To that end, parametric solutions are a win-win opportunity for insurers and policyholders in a game that is too often a zero-sum trade-off.

Doug Carsley (doug.carsley@capco.com) is a partner at Capco, the insurance and financial services consultancy. Carsley has more than 20 years of experience in financial services and consulting, on both the institutional and vendor sides of the industry. He has led the delivery of several large-scale projects focused on improving the customer experience from inception to implementation. He has run system integration and consulting businesses servicing Canada’s largest financial institutions.

These opinions are the author’s own.

Related:

"traditional" - Google News

July 22, 2020 at 11:15PM

https://ift.tt/3fSMM3V

How parametric products could impact traditional insurance - PropertyCasualty360

"traditional" - Google News

https://ift.tt/36u1SIt

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "How parametric products could impact traditional insurance - PropertyCasualty360"

Post a Comment